Condo Insurance in and around Blue Springs

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Home Is Where Your Condo Is

Are you committing to condo ownership for the first time? Or have you been around the block a few times? Either way, it can be a good idea to get coverage for your condo with State Farm's Condo Unitowners Insurance.

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Put Those Worries To Rest

With this protection from State Farm, you don't have to be afraid of the unpredictable happening to your biggest asset. Agent Chad Smith can help inform you of all the various options for you to consider, and will assist you in constructing a fantastic policy that's right for you.

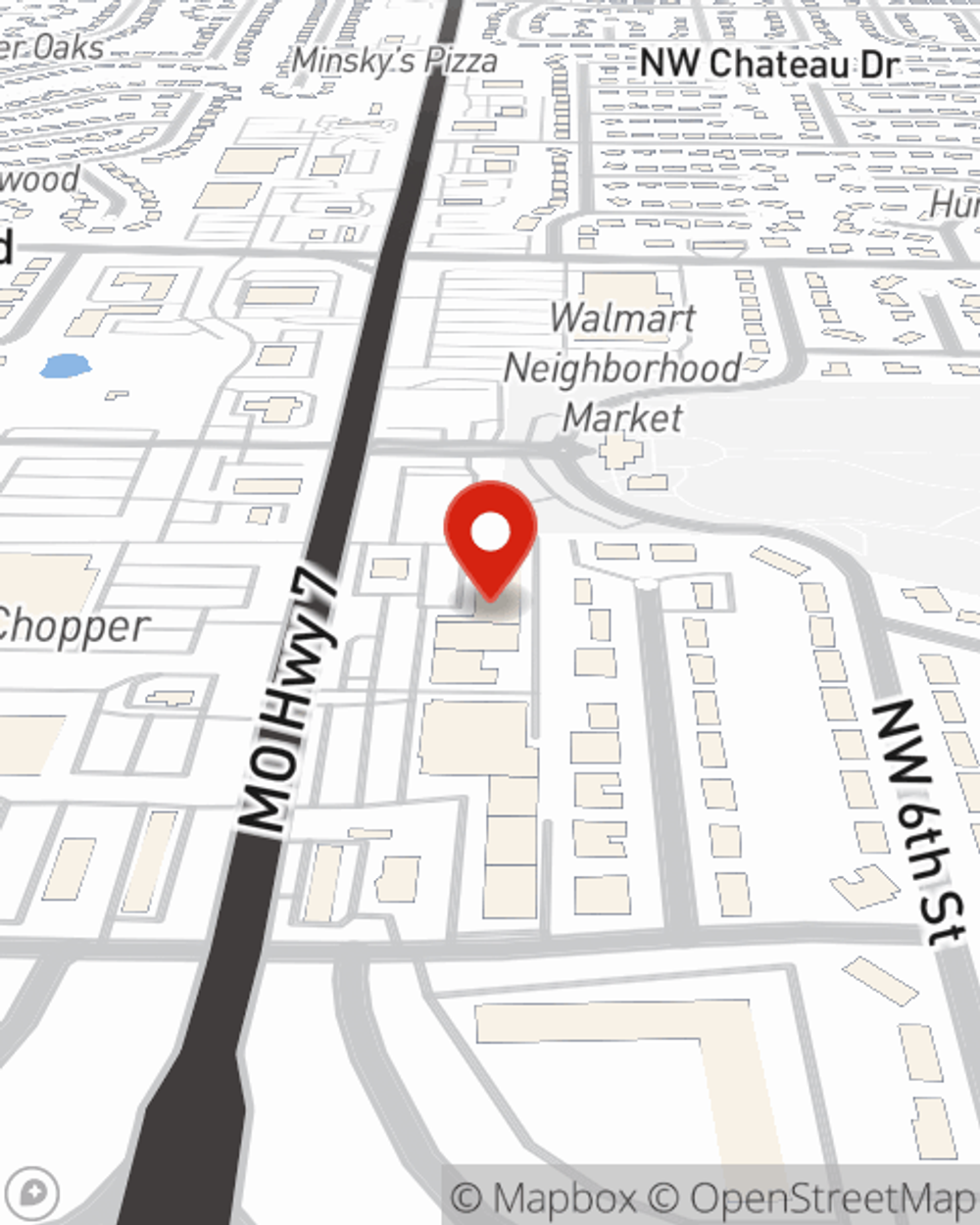

If you're ready to bundle or see more about State Farm's terrific condo insurance, visit agent Chad Smith today!

Have More Questions About Condo Unitowners Insurance?

Call Chad at (816) 229-1037 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.